No Matter Whose Math You Use, Verizon’s Holiday 2025 Promo Is Extremely Aggressive

“Verizon has an insane new holiday promo and I'm not sure they are using the same math as the rest of us.” That was my opening line in a series of social media posts when Verizon’s newest holiday promotion launched at 9 AM on Friday, December 5, 2025. The post provided some consumer-centric value calculations – this was a social media post, not an analytical report – but it generated considerable attention. My X posts were viewed over 180,000 times. My Threads posts were viewed over 1 million times. EVP and CEO of Verizon Consumer Group Sowmyanarayan Sampath responded to the LinkedIn version with a point-by-point rebuttal and then set up a call with me to discuss the promotion in person.

Context

Verizon's enterprise business is stable, but the consumer group has been bleeding customers (mostly to T-Mobile, but cable companies and AT&T have taken them, too). Verizon's new CEO Dan Schulman is being given a two-year contract to make dramatic changes, which apparently does not include cutting the dividend, so 15% of the workforce was cut and CapEx investment is being curbed instead. That won't get new subscribers, though, so unless it comes up with new ways of bundling services – and Verizon was already the most creative in this regard – Verizon has to change consumer perception about the service or lower prices to increase demand. The challenge with that is twofold: Verizon’s Welcome Unlimited was already low cost for a carrier plan, and Verizon does not want to be a low-cost brand. The solution: limited time promotions that partly maintain service pricing levels while adding unprecedented hardware discounts.

Verizon likes the fact that I call out the extreme value of the offer to consumers but doesn’t want Wall Street to think that Verizon is willing to lose money on this promotion to get top line growth, hence the comments on my LinkedIn and personal call.

Is Verizon’s Holiday 2025 promotion too good to be true?

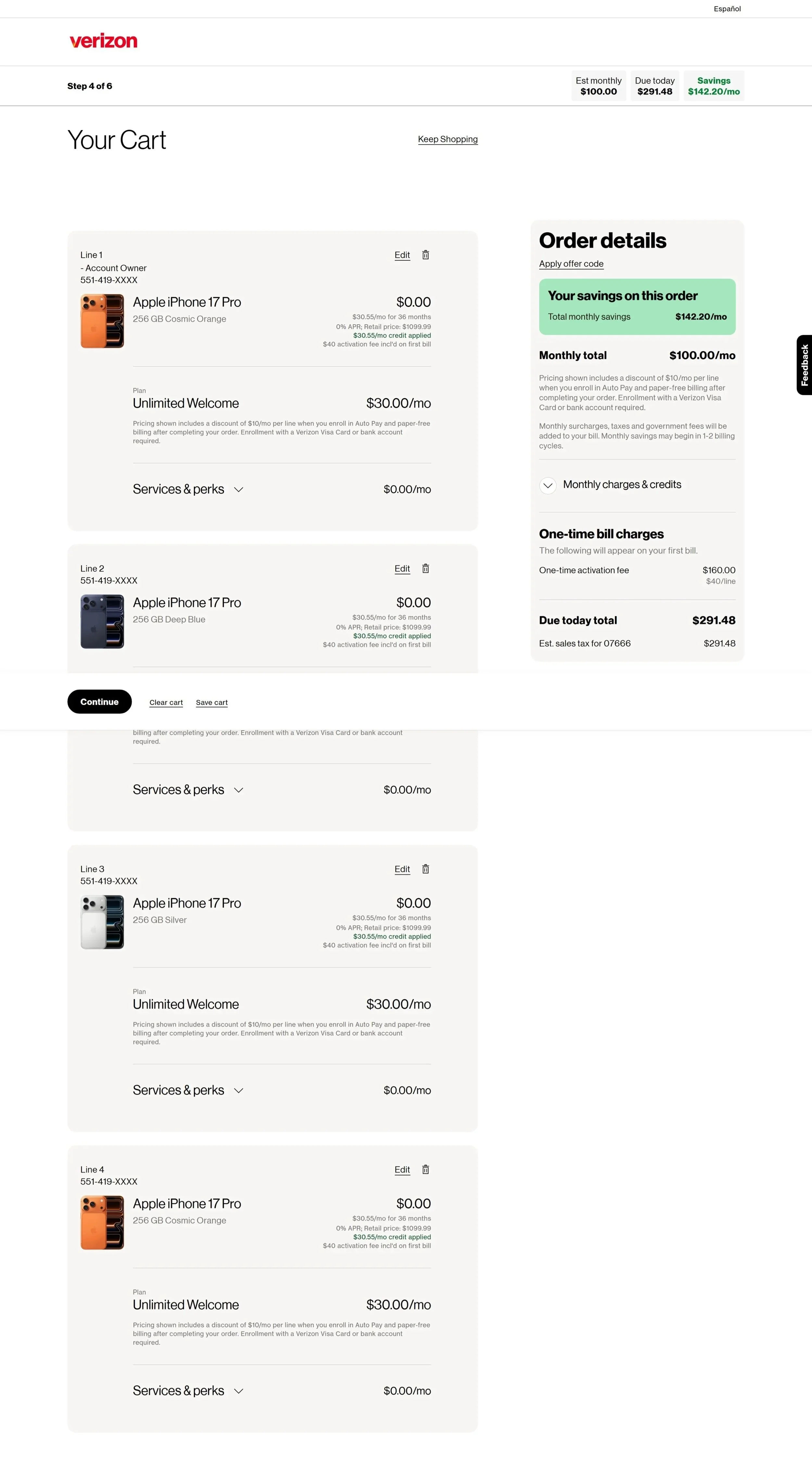

Actual configuration of Verizon’s 2025 holiday promotion. I didn’t complete the order, but I was tempted.

This is the most aggressive promotional offer I have seen in the U.S. in years. If consumers maximize this offer, Verizon will lose money on it. However, most consumers won’t take this exact offer for multiple reasons that Sampath called out. I’ll go through them below.

The promo I took a picture of here was live as of 9 AM December 5. It offers $25 per line for four lines, unlimited talk, text, and data, four free “Pro” phones with no trade-in required, and a $40 activation fee per line. At time of purchase, only sales tax (if any) is due on the phones, the full value of the phones is rebated over 36 months, and no finance charge is added. The offer is for new subscribers, with service pricing guaranteed not to change over the three-year period, so it’s not a bait-and-switch, and there’s no service plan contract, so any time you want to pay off the remainder of the phones and leave you can.

If you add this up using four iPhone 17 Pro:

Consumers pay:

$25 unlimited x 4 = $100 month x 36 months = $3,600 + service taxes & fees

$40 activation x 4 = $160

$0 iPhone Pro x 4 + [state sales tax if any] = [sales tax if any]

= $3,760 + service taxes & fees + [sales tax if any]

They get:

$3,600 worth of service

$4,400 worth of devices + 0% financing

= $8,000+

$3,760 paid - $8000 value = (-$4,940)

At face value, it would appear that Verizon is losing nearly $5,000 per account added. It won’t – see below – but from a consumer perspective that’s an insanely good value proposition if Verizon offers good coverage in your area.

How is Verizon doing this?

First, the math isn’t quite that bad from Verizon’s perspective. It costs Verizon money to add users to its network, but most CCPU (Cash Cost Per User) estimates I’ve seen suggest that Verizon should be profitable on the service itself at $25/month unless each user is calling customer service every month. That leaves Verizon at least some margin to offset the hardware costs.

Verizon also doesn’t pay retail for the phones that it buys from Apple …but Apple doesn’t leave the carrier much margin, either. Apple does give carriers that buy millions of iPhones some rebates but it is often structured as MDF (Market Development Funds) that must be used to promote iPhone sales on the carrier’s network, not general carrier marketing. Financing the purchase of the hardware upfront and rebating it back to the customer costs Verizon money, too. Sampath declined to provide me with exact numbers, but even if you assume that Verizon is only losing around $2,000 or so per account that takes this deal as is, it’s awfully costly.

Yet Verizon is not alone in offering $25/line for four lines of basic unlimited service and free hardware. T-Mobile has run promotions with this rate in the past, and it began offering this promotion in November — ahead of Verizon’s offer that prompted this report. T-Mobile isn’t as generous with the free hardware, offering four regular $830 iPhone 17 models rather than four $1100 iPhone 17 Pro, but it’s still a tremendous value for the consumer that is hard to justify with simple math.

That’s because this offer is a loss leader. Verizon will absolutely lose money on it if everyone maximizes the offer exactly as I configured it and leaves after three years, but Verizon knows that most people won’t. In other words, my math isn’t wrong, but Verizon didn’t lay off all their accountants in the recent cost cutting purge. Indeed, Sampath insists that Verizon modeled the effect of this promotion and only expects small percentage of subscribers take Verizon up on it without additional changes or purchases.

There are several structural and psychological constructs to the offer that Verizon is counting on:

This is a switcher promotion, so it only applies to new accounts. Verizon is not risking its existing profit margins; this is specifically designed to steal subscribers from rivals and reignite growth. (Existing accounts could leave for a month to an MVNO and then move back – I’ve seen people in my comments saying that they employed this exact strategy – but that’s an extreme approach that requires work and coordination.)

You only get the low $25/line monthly price if you bring four lines and choose Welcome Unlimited. One, two, or three lines are more expensive per line.

Verizon also expects that many people who are attracted to the offer will upgrade one or more lines to higher end plans for hotspot data and other benefits. Unlike T-Mobile, Verizon is able to upsell individual lines to different plans (and perks) within a family plan. It is not unreasonable for a family to have two Welcome Unlimited lines for light users, one Unlimited Plus for hotspot access, and one Unlimited Ultra for the international traveler or heavy mobile video watcher in the group.

Most people stay with a carrier for 8 – 10 years; even if the new subscriber costs Verizon money during the promotional period, it can start making money if they stay past the three-year mark.

Staying past three years is even more likely if any of those four phones break or the customer wishes to upgrade before the three year mark is up. At that point, that user will have to pay off the remainder of device cost and will almost certainly enter into a new three year device rebate cycle, thus incentivizing the entire group to stick with Verizon even after the other members of the family pay off their devices.

Due to the fear of breaking an expensive device that is not fully paid off until the end of three years, many people who take the deal will be upsold on insurance. And cases. Both are high-margin sales for the carrier.

Verizon can also upsell subscribers to other products – streaming video perks, credit cards, VZ cloud storage, connected watches, connected tablets, or even Verizon credit cards.

When an account has four lines attached, they often move to Verizon for broadband discounts as well; Fios in Verizon’s fiber footprint, and FWA elsewhere. This is usually not immediate – households do not usually switch wireless and broadband at the same time – but Verizon reports that its convergence strategy is working over time.

Sampath himself described the plan as a loss leader, comparing it to Costco’s $1.50 hot dog as a way to get people in the door and then sell them other things. However, there is another overarching reason to make aggressive promotional offers: Verizon is attempting to change consumer perception in the customer base that Verizon is a good value proposition. In that sense, the offer can serve a marketing purpose beyond any revenue it generates – or costs.

Sampath claims that Verizon is “extremely financially disciplined” and is not intent on starting a price war. This promotion is “temporary” and we should expect that it will expire after the holidays. Financial analysts are concerned that this could instigate a scorched earth price war, one that Verizon – which has higher costs than T-Mobile – cannot afford. We’ll see.

For Techsponential clients, a report is a springboard to personalized discussions and strategic advice. To discuss the implications of this report on your business, product, or investment strategies, contact Techsponential at avi@techsponential.com.